Filters

10 products

Wallet Accessories

Compliment any of our wallets with these accessories.

Wallet Gauntlet - RFID Blocking Card

Sale price

$14.25 CAD

Regular price$24.00 CAD

with code 12YEARS

Wallet Chain

Sale price

$24.00 CAD

Regular price$29.00 CAD

Money Clip Bar

Sale price

$19.00 CAD

Regular price$24.00 CAD

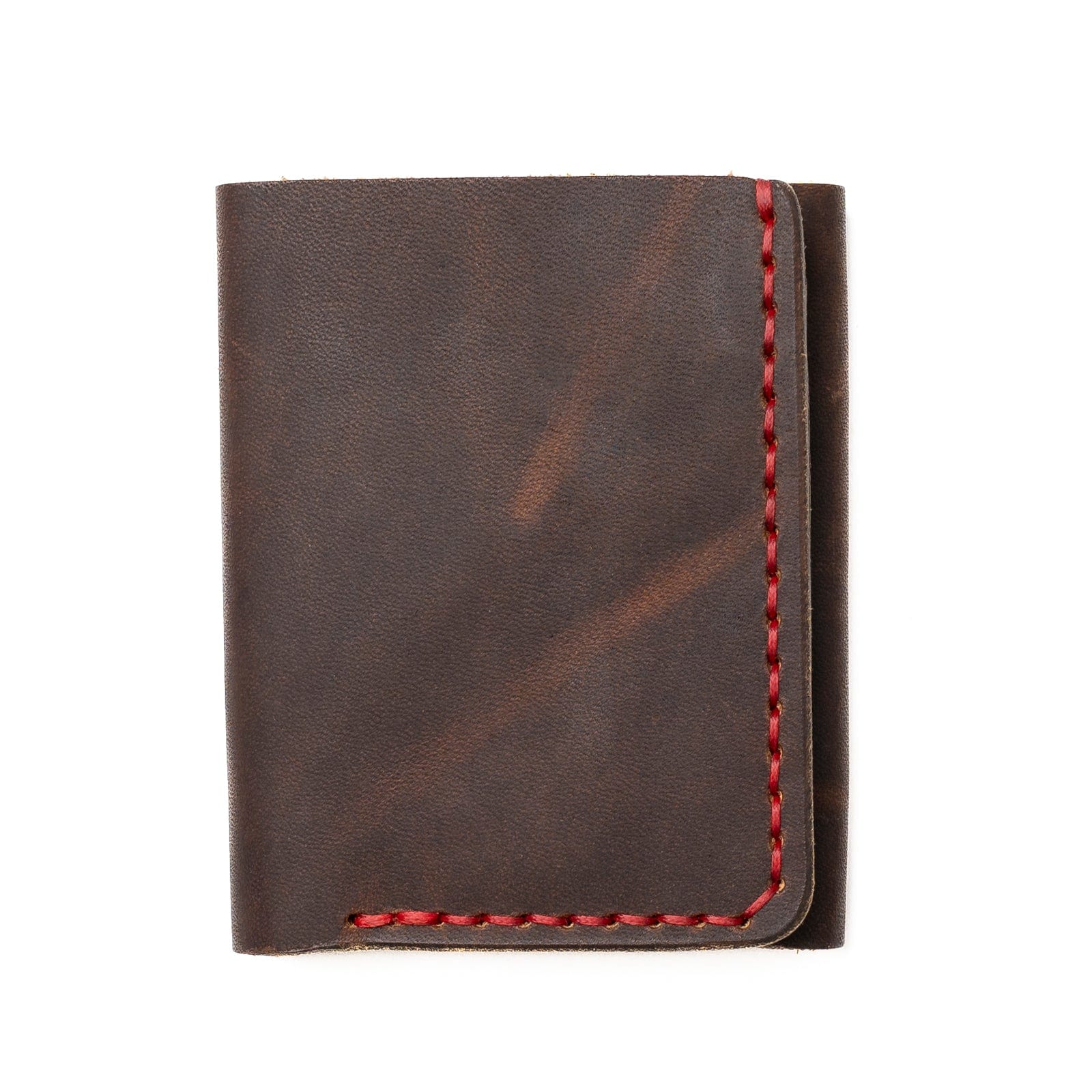

LEATHER WALLETS CRAFTED TO LAST.